HSBC

Updated

- Interest rates are low

- Get transparent services

- Free yourself from debt

In-page navigation

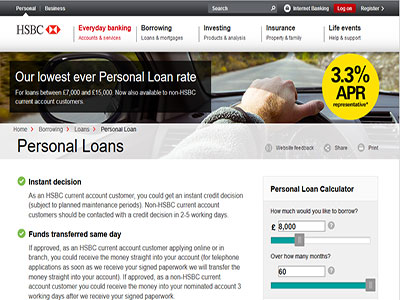

Author HSBC. Screenshot of HSBC website. [Accessed September 5, 2019]

About HSBC

Being in debt can be one of the most stressful situations that you can find yourself in.

This can be made worse if you don’t have a proper plan in place to help you handle your debt, which can result in it pilling up until you can no longer manage it yourself. It can seem hopeless and like you are never going to get out but we’re here to tell you that you can.

Our range of debt busting loans and services

We at HSBC offer (amongst other financial services) debt consolidation loans with each loan we provide helping the public regain control over their finances, one loan at a time.

Getting a debt consolidation loan can be the answer you need to help you get back on top of your debt. You’ll be able to gather all your debt into a single loan with a single monthly payment. This makes handling payments a lot easier and more convenient for you.

Save money in the long run

Having so many payments to make each month can become quite expensive so consolidating your debt can save you money in the long run.

HSBC Services

Our application process puts your needs first. We understand that simplicity and convenience are at the top of your list, that’s why we want to make things easy for you.

Simply let us know the total amount that you want to consolidate as well as how quickly you would like to pay it off. If you are an existing customer, we’ll be able to give you an instant decision.

Get your money fast

Once approved, we’ll provide you with the funds you need in the most time-efficient way. If you are not an HSBC current account customer, you can expect to receive your bad credit loan 3 days after we receive your signed loan agreement. The money will be deposited into a nominated account.

How much can you borrow?

Our personal loans range from £1,000 to £25,000. If you borrow £15,000 or less, you can borrow over a period of 1 to 5 years. However, if your loan is over £15,000, you can borrow for a period of up to 8 years. There are no hidden or nasty surprises with us. You have the option to make overpayments or make a full payment anytime, with no penalties!

HSBC Product Details

- Loan Type Debt consolidation loans

Summary of Services

- Get affordable loans

- Simple and easy loan application

- Low-interest rates

HSBC is the experts in debt consolidation

With years of experience under our belt and branches in countries all over the world, you can trust that we know what we’re talking about.

When you’re in a financial pickle, you want the peace of mind that comes with knowing that the people handling your money are competent enough to do so. Fortunately for you, we meet that criteria.

Excellent customer support

Count on us to provide you with customer support that you can rely on. Have any questions? We’re here to help. We value all of our customers, whether you’re already an HSBC customer or not, we offer a high standard customer service which we don’t compromise on.

Using the advantages of technology, we also have a virtual assistant available on our website, giving you the help you need fast and easy. Our goal is for you to leave satisfied with all your needs met, applying is as easy as submitting the online loan application form.

Personalised rates and fees

Your circumstance is unique to you- we are aware of that. That is why we take the time to individually assess your personal financial situation to help us arrive at a rate that is best for you.

Remember, we want to help you get into a position where you can regain control over your finances, so we make sure that everything we do will help you to achieve this.

We’ll help you decide what’s best for you

As attractive as a debt consolidation loan may seem, it’s still very important to take note that this option might not actually be the best for you.

For instance, you need to be aware that you might end up paying over a longer-term (compared to the remaining term of your existing debt) which means you could actually pay more- even if the new loan offers a lower interest rate- than you would’ve otherwise. We’ll help you decide on the best route for you.

Customer Reviews & Testimonials

HSBC Contact Details

Physical Address

- 56 Queen St Cardiff England CF10 2PX United Kingdom

- Get Directions

Opening Hours

- Monday 09:30 – 16:30

- Tuesday 09:30 – 16:30

- Wednesday 09:30 – 16:30

- Thursday 09:30 – 16:30

- Friday 09:30 – 16:30

- Saturday 09:30 – 13:00

- Sunday – Closed