Online short-term loans in the UK that are easy to access & obtain

Short terms loans are self-explanatory, the repayment period is short, between a few days to less than 12 months. The loan amount is also smaller, compared to long term loans, but interest rates are significantly higher.

Short term loans often categorise quick loans and payday loans, and these are easier to access and obtain, as the application process is less grueling and not needlessly lengthy.

When to use short-term loans

Reserved for short term problems like unexpected bills, school fees, medical expenses, purchases, or other situations that may require quick money.

Short-term loans come with peak interest rates, sometimes the borrower takes the loan to solve an emergency situation, without accounting for the high-interest rates that follow.

Financial experts advise that you must be 100% sure that you need the money quickly, before deciding to opt for short term loans.

What are my other financing options?

It is also recommended exploring other alternatives before diving straight into short term loans. The first option must always be seeking help from family and friends.

If you have anyone close, who can afford to help you financially, you should talk to them and draw up a loan agreement. This results in low-interest rates and flexible repayment terms that short-term loans from other lenders would not be offered.

As a small amount of money is needed, you can also obtain this by selling some smaller assets. If you do not have properties, vehicles or jewellery, then you can sell other items; like furniture or a flat-screen TV to get the money you need.

You lose your possession, but you save yourself from hefty interest and stress of repayments. Lastly, you must be sure that you are earning a stable income and in a financial position that would allow you to take a loan. That you will be able to make monthly repayments and would be able to pay back the loan in full, with interest.

Short-term loans may have higher interest rates

Short term loans are unsecured loans. This means that lenders do not require you to hold any asset as collateral or security in order to qualify for the loan. The process of obtaining a short-term loan is fast – this is because clients need money at moment’s notice.

As no collateral or credit checks exist, lenders do not have any form of security. The risk is too great, and this is precisely why the interest rates of short term loans are high.

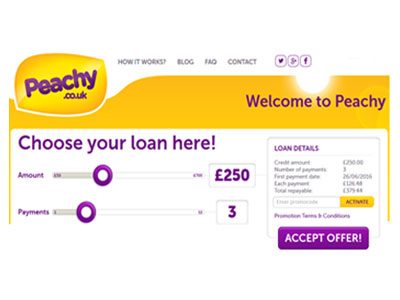

Finding the right short-term lender

As mentioned, short term loans are readily available in the UK. Banks do offer these, but as per usual the interest rates are pretty high, and terms are not flexible enough. A popular source of short-term loans is credit unions.

Credit unions are democratic parties ran by communities and you need to be a member in order to qualify for loans. Credit unions usually have a low APR, which make the interest rates are affordable. The repayment terms are also negotiable and much more flexible than what traditional lenders would offer.

Eligibility criteria for loan approval

You have to be a citizen or permanent resident of the UK before you can apply for short term loans in the UK. Thus, you should be able to provide your ID document and proof of address with your application.

You must be employed and earning a stable income before applying. This is vital, as you must be able to repay the loan. Good credit history is vital but not mandatory, as most lenders would consider individuals with bad credit.

All in all, short-term loans offer quick financing solutions!

The repayment term is short, and the terms are not as flexible as long-term loans. A lot of consideration should go into the decision-making process, and it's easy to slip up and land in trouble when dealing with short term loans.