You deserve the car of your dreams!

Car loans are popular in the UK. There are several ways that you can now get your dream car, many financing options are available. Car loans involve securing the money and then negotiating with the dealership.

You obviously should have an idea of what car you want, and which dealership would be able to help you. Knowing the specifics make the process less gruelling and you would be able to get your car faster.

It's easy to find a car loan in the UK

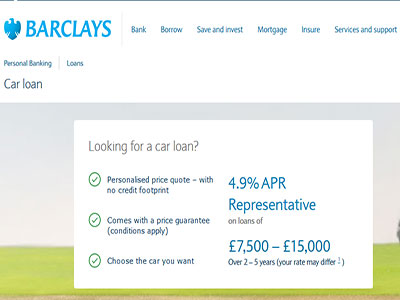

Almost all commercial and big banks provide vehicle loans in the UK. The interest rates may be higher, depending on the amount of the loan you are looking at.

Apart from banks, some dealerships also provide financing. They are either in contact with banks or independently loan you the amount you require. In this case, negotiation is vital.

Another source would be online lenders

In this technological age, some lenders prefer to deal with clients on the web, eliminating the hassle of paperwork and having face-to-face meetings. These lenders are harder to negotiate with which raises uncertainties in some clients.

As mentioned before, you must know which car you are looking for and you should have done your research. This is important to compare lenders.

Loan comparison websites are easily available, and you must look at APR, repayments, and the cost of loans before making a decision. Research is a vital component of this process.

There are several alternatives for getting your dream car

Buying a car requires a lot of money; the bigger and fancier cars are more expensive. Some people may have money saved up and this can be used to buy a car.

Some lenders offer loans with high interests, and if you manage to pay in cash, you save the money that would otherwise go in paying interest. Upfront payments in cash also allow you to get a discount on the purchase of a car, although this depends on dealerships.

Saving is also a sound financial choice

Some people may have savings, but not enough the pay off the car in a single payment. In this case, it helps to pay a larger deposit. This saves you money, as the interest rates are lowered, and the repayment terms are better- giving you more affordable vehicle finance.

If you do not have savings, then personal loans from banks are a good alternative. These loans come with affordable interest rates and are paid off in monthly installments. The installments are lower than what you would pay to private or online lenders, which is why this method is preferred.

As soon as the loan is approved, you can buy the car and it becomes your property. The car becomes an asset that can be used to pay off the loan later, by selling it. However, cars are subject to depreciation, meaning that their value decreases over time. This limits the usefulness in reselling after a few years.

Dealership vehicle loans are available

If you decide to apply for a loan from the dealership, then it would involve signing the hire purchase agreement. This means that you would not own the vehicle until the entire loan is paid off.

In this case, if you are unable to pay the loan till the last instalment, you end up losing the money you have paid so far, as well as the car. The dealership may also take you to court and take legal action.

The interest rates are fixed and not negotiable, and in addition, you are required to pay a 10% deposit. After this, monthly instalments follow.

Another form of agreement is a Personal Contract Purchase, which is much more flexible. You must pay a deposit and instalments, but the interest rate is fixed, and instalments are lower than that of HP contract. The loan term is usually between 1 to 3 years. In the case of PCP, you can trade the vehicle in for a different one or return it to the dealership.

The debate between new or old cars

In the UK, owning a used car is more popular than a new car. It all boils down to the nature of the deal. You might be able to find a discount on new vehicles that do not sell, making them cheaper than used cars.

Preowned cars usually come with high-interest rates and high insurance rates. Although these are easier to find, and their depreciation rate is lower, as opposed to new cars.

Do you have a bad credit record?

If you are looking for a car loan, you would need to have a good credit history. Its best to be on top of things, and hence you need to get hold of your bank statements and credit report.

If there are errors made, then you need to get them fixed. If you have non-repayments, then you should solve that and ensure you catch up on the payments.