Peachy

Updated

- Payday loans up to £1,000

- Low-interest starting from 248.37%

- Repayment up to 12 months

In-page navigation

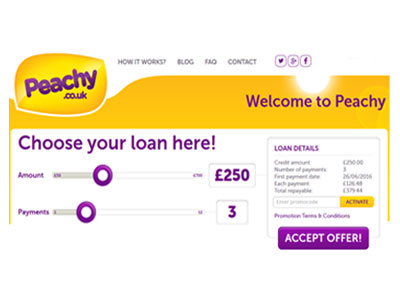

Author Peachy. Screenshot of Peachy website. [Accessed September 4, 2019]

About Peachy

Peachy is a short-term loan lender established in 2010.

We provide professional and responsible financial support to those who need a helping hand. Life’s events can be unexpected leaving you in a difficult predicament. Patchy is a financial service provider dedicated to assisting those who need a little financial boost.

We offer flexibility

We are a flexible short-term lender offering you a wide range of payback options short-term loans from £100 to £1,000. Most of our loan applications can be approved and processed within one hour. We are a trademark of Cash On The Go Ltd in the UK; offering payday loans with various repayment options available up to £1,000.

Make use of our budget calculator

- We offer flexible payback in instalments

- We are transparent with no hidden fees

- We are quick, cash paid out within hours

- We act responsibly with affordability checks carried out

Peachy Services

The idea is once you receive your salary, you repay the amount borrowed to avoid long term debt.

We would like for you to see us as a friend who helps you out or your employee giving you an advance on your monthly salary.

Naturally, a payday loan:

- is a smaller denominational value (the amount being borrowed)

- shorter repayment period 2 to the 3week timeframe

- payback is repaid in full at the end of the month, usually around your ‘payday’

- repayments in instalments for longer-term loans can be arranged

- are used for expected financial needs

The payday loan applications

We offer you a payday loan which is a temporary solution to your financial predicament, what this means is that we offer you a small amount of money to assist with your household expenses. A payday online loan application can be approved instantly, with the loan deposited into your account either on the day or the following working day.

Peachy Product Details

- Loan Type Payday loans

- Interest Rate from 248.37%

- Loan Amount up to £1,000

- Repayment 30 days to 12 months

Summary of Services

- Payday Loans

- Quick Cash Loans

- Short-term Loans

Peachy Loans is here for you during difficult times

It's these unexpected circumstances that may cause you to consider a payday loan.

We are here to help you cross this bridge. A payday loan, although regulated the same as bank overdrafts and credit cards, offers you way more flexibility in terms of your credit assessment.

When should you take out a payday loan?

Even with the best financial planning, households can still find themselves in a financial jam. Unexpected expenses seem to creep up leaving you in a very difficult situation. Here are some examples of these instances:

- broken or burst boiler

- payback of tax bills

- school excursions

- medical expenses

- vehicle breakdowns

- the loss of a job or regular income

Payday loan charges, fees and repayments

In the United Kingdom, all payday loans are regulated by the FCA, which has been designed to protect consumers from dishonest lenders. The FCA also requires that payday lenders provide their customers with sufficient, transparent information upfront.

As a payday loan is a short-term loan with a small amount lent, they, in turn, have a high APR. Simply put on small amounts borrowed over a shorter-term period, is how payday lenders recover their income.

When not to use payday loans

A payday loan is not a permanent financial solution, rather it should only be considered as a temporary measure or once-off solution. Payday loans are not suitable for, planned expenses like rent or mortgage payments, repaying debt, as well as gambling with the hope to make money.

We encourage you to plan ahead and only use payday loans in the event of life’s little emergencies. A Payday loan should only be considered a temporary short-term solution to your financial situation.

We are committed to better money management

Our resource centre includes up to date banking and mortgage industry news, as well as saving tips, credit cards and other types of debts. In addition, our resources include all things financial, savings, mortgages, overdrafts, credit cards and other types of debt. Furthermore, we offer customers financial support where they really need it most.

Customer Reviews & Testimonials

Peachy Contact Details

Physical Address

- 76 King Street Manchester Greater London United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 20:00

- Tuesday 08:00 – 20:00

- Wednesday 08:00 – 20:00

- Thursday 08:00 – 20:00

- Friday 08:00 – 20:00

- Saturday 09:00 – 17:30

- Sunday 09:00 – 17:30