Piggy Bank

Updated

- Payday loans up to £5,000

- Low-interest starting from 1212%

- Repayment up to 60 months

In-page navigation

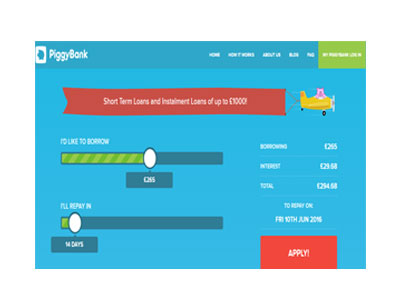

Author Piggy Bank. Screenshot of Piggy Bank website. [Accessed September 4, 2019]

About Piggy Bank

Piggybank is a short-term lender providing groundbreaking online borrowing solutions.

We strive to learn from market leaders and develop innovative financial services to support the needs of borrowers.

We are fair and responsible in lending

Our customers are at the core of what we do and we base our decision on the needs of our clients. Growth is important to us and we strive to maintain a growth culture in everything we do. We believe that great isn’t good enough and this philosophy echoes in everything we do. As an online loan lender, we place a great emphasis ensuring our software is safe and secure.

Our simple three-step process

- Step 1: Choose your amount from £100 up to £1000. Next, simply select a suitable loan term we offer repayments from 7 days up to 5 months

- Step 2: Complete our simple online application process. The following information is required: personal details, employment information, your income and expenditure as well as your bank account details.

- Step 3: Your application is assessed, and if approved you will receive a mobile pin. This pin will unlock the funds and the loan will be available to you within an hour. In the event that we need more information to process your application, we will let you know.

Piggy Bank Services

Our online account is easily accessible and user-friendly.

Simply, log on to review your PiggyBank statement, or update your banking details, or make an early repayment. We offer multiple repayment options for you should you wish to make an early payment or repay a portion of your loan.

Eligibility for a Piggybank loan

We have certain criteria which are required to qualify for a PiggyBank payday loan. Once you take out a loan with us, we will create an online account for you. This account will give you access to all information pertaining to your loan application including login details to access your personal PiggyBank account.

In order to qualify for a PiggyBank loan

- Own an active mobile phone – a mobile pin will be sent to you which you will need to enter into the system

- UK Citizenship – to qualify or a loan, you must be live and work in the United Kingdom

- 18 years and older- to qualify for a loan, you must be 18 years and older

- Be employed – you must work at least 15 hours a week to qualify for a loan

- Bank account – we will deposit the loan into your bank account, and use your debit card details to collect repayments

Piggy Bank Product Details

- Loan Type Payday loans

- Interest Rate from 1212%

- Loan Amount up to £5,000

- Repayment 3 months to 60 months

- Decision 1 hour

Summary of Services

- Direct lender

- Early settlement options

- Access your funds quickly

At Piggy Bank we lend responsibly

We are authorised and regulated by the Financial Conduct Authority (FAQ) as such, we follow stringent laws and regulations.

In addition, we are also associated with the Consumer Credit Act. We follow the key issues outlined in the Customer Charters and Lending Codes of the FLA, BCCA, CFA and CCTA and have devised our Short-Term Lending Code accordingly. If you have a bad credit history, you can still apply for a loan with us.

Our short-term loan lending code

- Highlight our commitments to you, as such including providing clear information about how the loan works, the price per £100 borrowed as well as the APR, and any additional fees incurred in the event of missed or late payment;

- We will explain how we will communicate with you and how you can reach us;

- We explain how we assess if you can afford a loan;

- We explain how to complain you experience an issue, and we will direct you to free resources like independent debt advice and relevant helplines alike.

New or existing customers

- We act responsibly in all our dealings with you

- We comply with all relevant legal requirements of the Financial Conduct Authority, in particular, relating to responsible lending.

- We ensure all our advertising and promotional material is clear, fair, not misleading

- We give you the full name and contact details of our company providing the loan, no ambiguity.

- We do not pressurize into taking out a payday or short-term loan.

Extending/deferring the term of your loan

- We will only extend/defer the term of your loan should we believe it is in your best interests and after conducting an affordability assessment:

- We will not burden you to extend/defer the amount you currently owe.

- We can consider extending/deferring your loan term if you ask us

- We will have to conduct a thorough and appropriate affordability assessment in order to determine the term of your loan extension

- We always clearly communicate any additional costs of extending/deferring the term of your loan.

Customer Reviews & Testimonials

Piggy Bank Contact Details

Physical Address

- Piggy bank, 28 Avenue Rd Bournemouth BH2 5SL United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 16:30

- Tuesday 08:00 – 16:30

- Wednesday 08:00 – 16:30

- Thursday 08:00 – 16:30

- Friday 08:00 – 16:30

- Saturday – Closed

- Sunday – Closed