Satsuma Loans

Updated

- Quick loans up to £1,000

- Repayment up to 12 months

In-page navigation

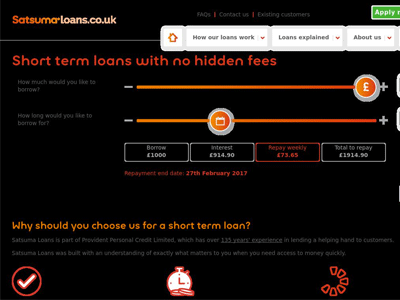

Author Satsuma Loans. Screenshot of Satsuma Loans website. [Accessed September 4, 2019]

About Satsuma Loans

Our products are always crafted having you in mind.

We know you don’t always want to loan £1 000’s which is why we only supply short-term loans- up to £1 000 for your first loan and up to £2 000 if your loan from us again.

We’re Satsuma Loans

Unlike others, especially payday lenders, we understand that it’s not always feasible to repay a loan in one big lump sum, but that’s ok because our loans are paid back in instalments on a monthly or weekly basis. If you’re finding it difficult to repay on time are unexpected additional charges of costs but with Satsuma Loans you don’t need to worry about unexpected costs because there aren’t any.

Manageable repayments

Our loans are paid back in monthly or weekly instalments agreed with you upfront. Our repayment arrangements are flexible- so if you need longer to pay back, that's fine, all we ask is that you talk to us about restructuring a more flexible repayment term. There are absolutely no extra fees or costs whatsoever- so consumers know they will never pay more than what was agreed upfront.

Satsuma Loans Services

Provident Personal Credit Ltd is part of the Provident Financial Group, which has lots of experience in loaning responsibly throughout the UK and Ireland.

So although Satsuma Loans may seem like a comparatively new brand, we’ve actually been around for a long time over 135 years to be precise! Understanding your needs and keeping your best interest at heart is what we do-its in our DNA.

Guarantor loans alternative

No guarantor loans, use SmartCheck to check your capability before you apply, without affecting your credit rating. If you have a bad credit history, you may be considering a guarantor loan.

The difference between guarantor or no guarantor

When you apply for a loan with no guarantor the loaner will run a credit check on you before deciding whether to accept your application. You are solely responsible for paying back the loan. But guarantor loans work a little differently. In this situation, you ask someone you know to guarantee the loan for you. This means they agree to make any payments should be unable to do so.

Satsuma Loans Product Details

- Loan Type Quick loans

- Loan Amount up to £1,000

- Repayment 3 months to 12 months

Summary of Services

- Short-term Loans

- Bad Credit Loans

- Quick Loans

- Flexible Loans

You can get a loan even if you have bad credit

Our SmartCheck tool will make getting a loan quicker.

SmartCheck is our online tool to see if you qualify for a Satsuma loan. Simply confirm your name and address and answer a few effortless questions and you can find out if you’re eligible for a loan. SmartCheck will tell you immediately if you qualify for a loan. It will also tell you how much you’re able to loan. This happens without affecting your credit rating at all. If you feel like debt is getting you down, then it might be time to consider a debt consolidation loan.

No nonsense guide to loans

Most of us work hard to plan and manage our capital and family finances, but when you’re faced with an unforeseen expense and need to loan it’s imperative that you find the right quick cash loan for you and one that you can afford. Taking a moment or two to look at your alternatives before you start your application will help you feel sure the loan you’re choosing is the right one for you.

We’re a responsible lender

So we ask you to be too. We examine to make sure you can afford loan paybacks before we transfer capital and we always ask you to establish the loan repayments are manageable for you. All of this helps you to build a better credit rating, which means that you can get further loans from us if you need, but it might also assist with credit for things like home loans.

How guarantor loans work

Applying for guarantor loans can take more time than other online loans. Though the process may differ between loaners the usual procedure is that you, the lender, firstly completes an online application form. The next step is for your guarantor to finish their own application. You must both provide information about income and outgoings. Anyone can apply for a guarantor loan. As long as you can find a guarantor with a very satisfactory credit rating.

Loans for bad credit with no guarantor

If you have a bad credit past you can still apply for a short term loan from Satsuma. And you don’t need a guarantor. Here at Satsuma, we celebrate the most imperative thing is your capability to pay back the money we loan to you, regardless of your previous credit history.

Customer Reviews & Testimonials

Satsuma Loans Contact Details

Contact Number

Website

Physical Address

- 1 Godwin St Bradford BD1 2SU United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 18:00

- Tuesday 08:00 – 18:00

- Wednesday 08:00 – 18:00

- Thursday 08:00 – 18:00

- Friday 08:00 – 18:00

- Saturday – Closed

- Sunday – Closed