Barclays

Updated

- Student loans up to £10,000

- Low-interest starting from 6.2%

- Repayment up to 60 months

In-page navigation

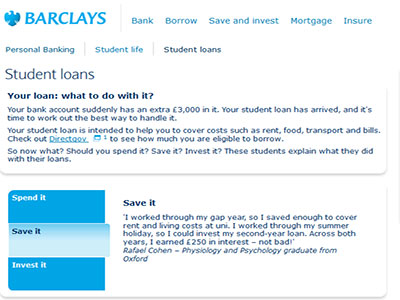

Author Barclays. Screenshot of Barclays website. [Accessed September 5, 2019]

About Barclays

Barclays moves, lends, invest and protects capital for consumer and clients worldwide.

Our regular purpose is creating opportunities to rise. We are a company of opportunity creators working together to help people rise-consumers, clients, colleagues and society.

We’ll measure and reward our people

Not just on commercial results, but how they live our values and bring them to life every day. We as a British bank is devoted to the United Kingdom and will do whatever we can to assist our consumers and clients to deal with the changes from Brexit vote.

Diversity and inclusion are some of our strong points. We believe every one of our employees, clients and stakeholders brings a set of special skills and perspective to the table.

Board responsibility and board committees

The Board’s principal duty is to generate and deliver sustainable shareholder value by setting Barclay's master plan and overseeing its implementation. Certain responsibilities are assigned to Board Committees, which assist the Board Committees, which helps the board in carrying out its functions and makes sure there is independent oversight of internal control and risk control.

Auditor independence

We are a British bank that is devoted to the United Kingdom. We will do whatever we can to assist our consumers and our clients with student loans.

Barclays makes sure that employees of all backgrounds are treated equally and contribute fully to our mission and goals. We believe every one of our employees, clients and stakeholders brings a set of special talents and perspectives to the table.

Barclays Services

Baffled by borrowing? Read our guide to debt -the good, the bad and the ugly-and get advice and tips for staying on top of it.

These days, loaning capital- whether it’s from your bank, mum and dad or a student loan- is normally unavailable. But loaning, and the debt that comes with it isn’t necessarily a bad thing.

Repay the loan after graduating

Wherever you’re studying in the UK, it’s likely to be tough to pay back. If you’re a UK resident, that you’ve taken out a student loan to cover your tuition fees. With graduates in England leaving university with reasonable debt, it can be hard to imagine how or when you’ll ever be able to repay it. Don't panic. You won’t be expected to pay it off the minute you’ve thrown your cap in the air at your graduation.

Late loan instalments

When you’re struggling at the end of term, it might be enticing to go to a payday loan lender for a bit of extra capital. What’s the harm if you’re going to be able to repay it back in a few weeks, right? Wrong.

Payday have very high-interest rates (this means you’ll pay back a lot more than you borrow), and -as with all loans you take out- they can influence your credit score badly if you don’t repay them on time.

Credit cards as a backup

When used tactfully, a credit card can be a good way of staying in control of your capital. They can be convenient for spreading the cost of a big purchase. However, it’s simple to lose control of your spending.

If you make repayments on time each month, using a credit card also helps prove to loaners that you are a responsible borrower. That can boost your credit rating making it simpler to get a mortgage, loans, credit cards even cell phone contracts in the future.

Barclays Product Details

- Loan Type Student loans

- Interest Rate 6.2 – 9.9% p/a

- Loan Amount up to £10,000

- Repayment 12 months to 60 months

Summary of Services

- Repayment starts when studies finish

- No charges for early payment

- No costs or charges hidden

Join us and you"ll definitely enjoy the benefits

We’re different to most other loaners-in many cases we'll give you a personal price quote upfront. You’ll see the rate you’ll actually get and the quote won’t influence your credit score.

Money straightaway

You could get your capital straightaway, as you apply online and get accepted or if you download or print your agreement and sign it.

Repaying your loan early

You have the right to pay back your loan early, in part or full, at any time. We’ll charge a fee equal to 30 days interest on the amount you’re paying back, as well as any other interest that’s due.

Affordable car loans

Drive a better car with a car loan. When it comes to purchasing your next car, knowing you’ve got the capital in your back pocket can help you get a better deal.

How to consolidate your debt

If you have borrowed from different loaners, a debt consolidation loan could help you take control of your capital and keep track of your finances.

Customer Reviews & Testimonials

Barclays Contact Details

Physical Address

- 2 Churchill Pl London England E14 5RB United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 16:00

- Tuesday 09:00 – 16:00

- Wednesday 10:00 – 16:00

- Thursday 09:00 – 16:00

- Friday 09:00 – 16:00

- Saturday – Closed

- Sunday – Closed