QuidMarket

Updated

- Quick loans up to £1,500

- Low-interest up to 292%

- Repayment up to 6 months

In-page navigation

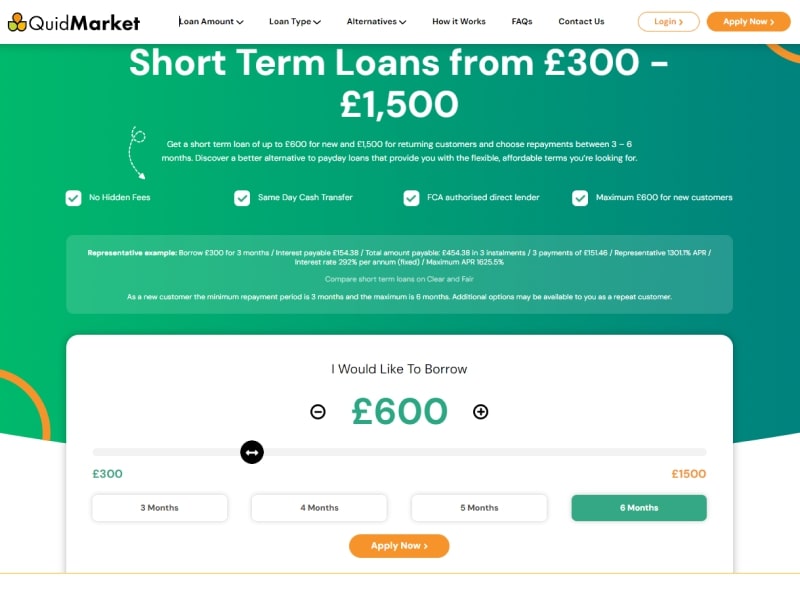

Author QuidMarket. Screenshot of QuidMarket website. [Accessed July 25, 2023]

About QuidMarket

QuidMarket stands out as a reliable direct loan provider, offering same day loans with a unique, customer-centric approach.

Since its inception in 2011, the company has been committed to assisting hard-working individuals navigate their short-term financial challenges, particularly those with less-than-perfect credit histories.

Going beyond algorithms: QuidMarket's human-centric approach to loan decision-making

QuidMarket prides itself on its efficient and user-friendly and personalised loan process. Every application is personally reviewed by their dedicated team of underwriters and not by an impersonal algorithm. This human touch ensures a fair and accurate decision-making process, taking into account a variety of factors, including the affordability of repayments.

QuidMarket is known for its customer-centric approach, with a focus on understanding the needs and preferences of its target audience. They have a strong reputation for their service, as evidenced by their 'Excellent' rating on Trustpilot.

QuidMarket's guarantor-free loan solutions

When obtaining a loan with them, there is no need to provide a guarantor or any form of collateral as security. This is particularly beneficial if you don't have someone to vouch for you or possess valuable assets to offer as collateral.

It offers you greater accessibility to financial services, especially if you have limited resources or credit history. By eliminating the need for a guarantor or collateral, QuidMarket enables more people to access same-day loans, providing you with the opportunity to fulfil your needs and aspirations.

Regulatory compliance and industry recognition

QuidMarket operates under the strict regulations of the Financial Conduct Authority (FCA), having secured its license on the first attempt. This achievement underscores the company's commitment to ethical lending practices and its reputation as a trustworthy, transparent lender. Furthermore, as a member of the Consumer Finance Association (CFA), QuidMarket actively contributes to industry discussions and compliance modifications.

Empowering you with affordable options and uncompromising privacy protection

QuidMarket offers you a more cost-effective solution, eliminating the need for brokers and their interrelated fees. The company also respects your privacy, only sharing information with third parties when explicitly permitted by you.

Their unique blend of customer-focused services, flexible loan terms, and regulatory compliance makes it a standout choice for those seeking short-term financial solutions.

QuidMarket's commitment to responsible lending, its focus on customer service, and its ability to provide quick and easy financial solutions to its customers. Their strong online presence and positive customer reviews are key strengths that can be leveraged in marketing campaigns.

QuidMarket Services

Their affordable same-day loans are designed to provide financial relief when you need it most.

They offer a borrowing range from £300 to £600 if you're a new customer and up to £1,500 if you're a returning customer. The amount you can borrow is contingent on your financial capacity, ensuring that the loan remains manageable.

Quick same-day loans with flexibility and transparency

Unlike traditional payday loans, QuidMarket offers the flexibility to spread the cost over three to six months, starting from your next payday. The company's transparency is evident in its commitment to no hidden fees and its easy-to-use online tools that help you determine what is affordable for you.

Tailored quick loan repayment plans and transparent pricing

QuidMarket's unique approach allows you to customise your loan terms to suit your needs. Their user-friendly interface features adjustable sliders, enabling you to determine the loan amount and repayment schedule that best fits your budget. The platform provides a clear breakdown of interest rates and monthly repayments, ensuring you understand the full cost of your loan.

Unlike some lenders, QuidMarket prides itself on transparency, with no hidden administration or transfer fees. The amount you see is the amount you'll repay, providing peace of mind and clarity.

The benefit of repeat borrowing

Once you've cleared your current loan, you're free to apply for another if needed. The process for repeat customers is expedited, and provided your financial circumstances haven't changed, you may even qualify for a higher loan amount. Having that said, QuidMarket emphasises responsible borrowing, advising you to only borrow what you need and ensure repayments are affordable.

Penalty-free and flexible repayments to strengthen your credit score

QuidMarket's short-term instalment loans are designed to assist with temporary financial challenges. As such, they only charge interest for the days you have the loan. If you're in a position to repay your loan early, their experienced team is ready to assist, calculating the exact amount you need to settle. There are no early settlement or administration fees, and early repayment won't impact your credit score or relationship with QuidMarket.

QuidMarket's same-day loans offer a flexible, transparent, and customer-focused solution for short-term financial needs. However, they remind customers that these loans are a costly form of credit and encourage those facing prolonged financial challenges to seek advice from the Money Advice Service.

QuidMarket Product Details

- Loan Type Quick loans

- Interest Rate 292%

- Loan Amount up to £1,500

- Repayment 3 months to 6 months

Summary of Services

- Flexible & affordable terms

- Same-day cash transfer

- No hidden fees

- Easy online loans

A comprehensive guide to unlocking same day loans with QuidMarket

With QuidMarket's quick loans, you can access funds promptly, often on the same day of approval. This article will guide you through the application process, approval criteria, and how to submit a claim.

1. The application process: A walkthrough

QuidMarket has simplified the application process to ensure convenience for you. The application form, created to be user-friendly, only requests essential information necessary for processing your loan. This efficient approach means that completing the application should only take a few minutes of your time.

To initiate your application, you'll need to use the sliders on the QuidMarket website to select your desired loan amount and repayment duration. Once you're satisfied with the repayment terms, you can proceed to the application form.

2. Approval criteria: What you need to know

QuidMarket's application process involves standard loan approval factors such as credit history, income level, and employment status.

3. Required information: Keeping it simple

QuidMarket's application form requires you to provide the following:

- Personal details: your title, first name, surname, mobile phone number, and email address.

- Employment information

- Bank details

- Your income and expenses

- The amount you’d like to borrow

The QuidMarket promise: Same-day cash transfer

One of the standout features of QuidMarket's quick loans is the promise of a same-day cash transfer upon approval of your loan application. This means that as long as you meet their lending criteria, you can have the funds in your account when you need them most.

Applications made outside of business hours may be processed on the next working day. This swift service underscores the company's dedication to meeting its customers' urgent needs.

Customer Reviews & Testimonials

No reviews for this business.

QuidMarket Contact Details

Physical Address

- 6 Broadway Nottingham NG1 1PS United Kingdom

- Get Directions

Opening Hours

- Monday 08:30 – 16:30

- Tuesday 08:30 – 16:30

- Wednesday 08:30 – 16:30

- Thursday 08:30 – 16:30

- Friday 08:30 – 16:30

- Saturday – Closed

- Sunday – Closed