Bank of Scotland plc

Updated

- Vehicle finance up to £35,000

- Low-interest starting from 3.9%

- Repayment up to 7 years

In-page navigation

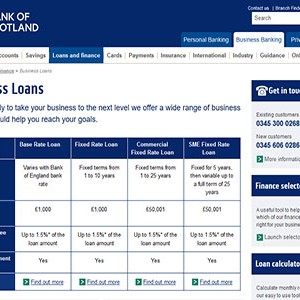

Author Bank of Scotland plc. Screenshot of Bank of Scotland plc website. [Accessed September 4, 2019]

About Bank of Scotland plc

Only the Bank of Scotland can ensure that your car loans in the UK meet all your personal needs as a prospective automobile owner.

Be sure to consult our car finance calculator to get a good general idea of a potential fixed or flex car purchase plan. You can also obtain an obligation-free quote, which does not require a credit search as we already know you, from our website.

The benefits of our car finance plans

Our Car Finance Plus will allow you to buy either a fixed (hired purchase) car loan or flex (personal contract purchase) car loan, with 3.8% APR representative if you borrow between £7,000 and £25,000, and no early repayment charges. Generally, you can borrow between £3,000 and £60,000 with our Car Finance Plus.

A fixed car finance plan

With your fixed car plan, your monthly payments are fixed, you will own the car after your loan is fully paid, and you will have no mileage limit; your flex car plan features low fixed monthly payments and the choice at the end of these payments to either return the car or own it in exchange for the lump sum.

Bank of Scotland plc Services

If competitive pricing, quality and customer service are the order of the day, our car loans in the UK fit the bill.

After your application is accepted, you will be given 90 days to accept our excellent car finance offer, and no matter how many applications you submit, we will not conduct a credit search. Please feel free to phone us about any questions you have regarding your online application.

The benefits of our service

You do not have to be on the electoral/voters role for us to approve your car finance loan. No paperwork from your side will be required, as details of your finance agreement will be emailed to you. We will then send you a welcome letter to confirm your monthly payments and direct debit details. You always retain your right to terminate your car loan deal.

A loan that gives you control

With your online Car Finance Plus account, you can make a payment, check your statement and change your payment date, by entering in the agreement number we will send you, or phone us if you have lost this number. If you have added a part to the car, we would be willing to remove and return it to you, if you ask in writing, and for a fee.

Bank of Scotland plc Product Details

- Loan Type Vehicle finance

- Interest Rate 3.9 – 29.9% p/a

- Loan Amount up to £35,000

- Repayment 1 year to 7 years

Summary of Services

- Easy and fast loan applications

- Speedy loan decisions

- Monthly repayments are fixed

We secure your car finance journey

Our attention to detail and accommodation of your challenges are why the wise seekers of car loans in the UK come to us.

You can open a joint account so that whoever is signed in when they apply for a loan will be the one who will be registered with the loan. You can request an early settlement figure online if you want to conclude your deal early, and our customer service team will be more than willing to help you.

The flexibility of our personal loans

If you would prefer to deal directly with a private seller or dealer, you could take out a personal loan, and therefore be able to borrow between £1,000 and £50,000. Other benefits of this strategy include owning the car from the start, not having to only use the loan for the car, and consolidating all these debts into one loan in order to facilitate easier payment. An unsecured personal loan with us also does not require a deposit.

Our unique loan process

After you choose your car at a selected dealership, we will pay them, either that day or the next after you sign all the online legal documents, directly for your convenience so that you can drive off and start your car finance journey much sooner. Additionally, we will assist you in resolving any disputes between you and the dealer.

Car finance loan convenience and accessibility

You may apply for a car finance loan if you are a UK resident aged 18 or over who are registered for internet banking and has held your existing Bank of Scotland personal current account for at least 3 months. We also accept applications for a car loan from clients with bad credit. This loan also allows you to buy either a new or used car. You are also permitted to part exchange with the dealership.

Exemplary car insurance with Bank of Scotland plc

- You get 3-year repairs to guarantee at approved garages

- a 24-hour emergency windscreen helpline

- new car replacement if you had owned the car new for less than twelve months

- vandalism cover

- a courtesy car while your car is at an approved repairer

We offer high-quality supplemental insurance too

You can also enhance your policy with breakdown cover features such as EU, onward travel, recovery, at home and roadside cover, that operate on a yearly basis. Keycare cover with us includes up to £1,000 cover throughout the EU, for locking your key in your car, including cover for nearby and immediate family, and no applicable access, as well as not affecting your no claims cover.

Guaranteed replacement car cover lends you a car from a leading national network for 28 days if you claim within 14 days after your car is burnt, stolen or in an accident. The best choice for car loans in the UK can only be the Bank of Scotland.

Customer Reviews & Testimonials

Bank of Scotland plc Contact Details

Physical Address

- 10/16 King Edward St Perth PH1 5UT United Kingdom

- Get Directions

Opening Hours

- Monday 09:00 – 17:00

- Tuesday 09:00 – 17:00

- Wednesday 09:00 – 17:00

- Thursday 09:00 – 17:00

- Friday 09:00 – 17:00

- Saturday 09:00 – 15:00

- Sunday – Closed