uSwitch

Updated

- Loans bad credit up to £35,000

- Free application

- Repayment up to 35 years

In-page navigation

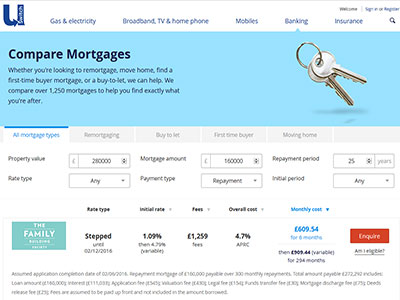

Author uSwitch. Screenshot of uSwitch website. [Accessed September 4, 2019]

About uSwitch

Are you tired of overpaying on your bills? Would you like to save money? With uSwitch we can help you do just that!

USwitch is a comparison and switching service that assists customers in comparing the prices on a range of products and services via the internet or telephonically.

Why should you switch to uSwitch?

As a comparison broker, we do not charge you any fees for our services. The information that we gather on any of the listed products and services is accurate and up-to-date with the information that our suppliers have given us. With uSwitch we strive to help you find the best product or tariff for your needs. We also offer comprehensive information on all the products and services available.

Understanding interest is in your best interest

Finding the best bad credit loan rate is often a difficult task as it is heavily dependent on the amount of money borrowed and the period of time borrowed for and not just the lender you choose. It is a common assumption to believe that the less money you borrow, the lower the interest rate will be but this is not the case.

uSwitch Services

Our website offers various loan comparison tables from trusted lenders tailored especially for people with bad credit.

We will assist you to find the best match for your current needs and circumstances.

Are secured loans right for you?

The most important characteristic of a secured loan is that the borrower uses their home as a means of security. This implies that the lender has the right to claim your home if you are unable to meet the monthly repayments. Secured loans are often good options because of lower interest rates. Our lender suppliers offer secured personal loans from a value of £1000 to £150 000.

Guarantor loans for guaranteed money

A guarantor loan is a type of unsecured personal loan for borrowers with poor credit records. In order to qualify for this type of loan you need a registered guarantor – this refers to a trusted individual that can vouch for your ability to repay a loan despite your credit score and offers themselves as security to meet the loan repayments should the borrower be unable to do so. Our lender suppliers offer unsecured loans from £1000 to £50 000.

uSwitch Product Details

- Loan Type Loans bad credit

- Loan Amount up to £35,000

- Repayment 12 months to 35 years

Summary of Services

- Loan compare

- Loan application is free

- Loans for people with bad credit

We promise to stand by you to find the best lender

You might need vehicle repair, debt consolidation or home improvements.

Sometimes getting a loan can be considered an investment in itself especially when performing home improvements.

Affordable interest rates

The APR that is set is often an indication of the risk the lender sees in lending the money – a high APR could indicate that the lender sees you as a high-risk borrower. If you already have a loan where you pay a high-interest rate, a means to combat this would be to pay additional amounts on your loan monthly to reduce your overall balance thus reducing the amount on which interest can be accrued and paying your loan off faster.

Need some more living space?

Whether you want to grow your family or build a room for your gym equipment, we can find a home improvement solution for you. Expanding or improving your home can be a costly endeavour but this cost can be beneficial to you too. Expanding or improving your home can add to the property value of your home. Often the value that is added is greater than that of the home loan you acquired which means that the loan effectively paid itself in a sense-making this a great option for you!

Are you drowning in debt?

If you have multiple credit cards and a loan that you are paying off, the amount of interest accrued across these debts can be quite a hefty amount. Why not consider getting a debt consolidation loan wherein your existing debts are combined into one loan with one rate and one repayment amount? This saves you money to use elsewhere!

Customer Reviews & Testimonials

uSwitch Contact Details

Physical Address

- The Cooperage 5 Copper Row London SE1 2LH United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 21:00

- Tuesday 08:00 – 21:00

- Wednesday 08:00 – 21:00

- Thursday 08:00 – 21:00

- Friday 08:00 – 20:00

- Saturday 08:00 – 18:00

- Sunday 10:00 – 16:00