Tesco Bank

Updated

- Debt consolidation loans up to £35,000

- Low-interest starting from 2.9%

- Repayment up to 10 years

In-page navigation

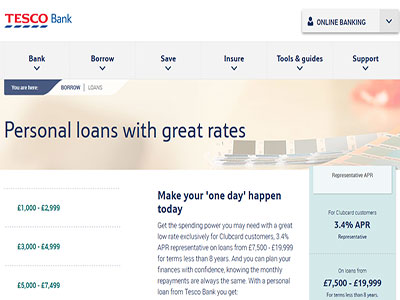

Author Tesco Bank. Screenshot of Tesco Bank website. [Accessed September 5, 2019]

About Tesco Bank

Serving the British public through top financial services is what Tesco Bank is all about.

All of our products are simple and straightforward because we believe that’s how banking should be. We listen to our customers, allowing us to provide you with the right products that meet your needs. So when you come to us for assistance, have the peace of mind in knowing that you come first- always.

Overcome the burden of debt

Being in debt doesn’t only take a financial toll on you; it can also take an emotional one. The stress can really affect your quality of life, preventing you from living your life freely and to the fullest.

Debt consolidation loans

Driven by a desire to better the lives of our customers a little more each day, we want to give you the best possible opportunity to make sure that you control finances, instead of it controlling you. Apply for a debt consolidation loan or a bad credit loan today.

Tesco Bank Services

While there is no such thing as a quick fix, there are still options available to assist you. One such option is a debt consolidation loan.

A debt consolidation loan lets you merge a number of your existing debts into one loan so instead of having your debts all over, it allows you to put them all in one place. Wrapping multiple debts into one means that you only have a single monthly payment to worry about.

Fixed monthly payments

This can significantly reduce your load and simplify your finances. The monthly repayments could be lower than your original repayments and the new term could be shorter, meaning that you can actually end up paying off all your debts quicker and save money on top of that.

Fixed personal loans

Our personal loans have fixed monthly repayments, which means that you will have to pay the same amount every month during the entire term of your loan. Therefore, you’ll be able to manage your finances better since you can draw up a budget to help you keep track of everything.

Tesco Bank Product Details

- Loan Type Debt consolidation loans

- Interest Rate 2.9 – 24% p/a

- Loan Amount up to £35,000

- Repayment 1 year to 10 years

Summary of Services

- Save money with low-interest rates

- Manage your debt with affordable loans

- Receive your decision quickly

A debt consolidation loan is right for you

We offer rates as low as 3.0% with a maximum rate of up to 29.8%.

The rate we can offer you will depend on your loan requirements along with your personal circumstances. We perform thorough credit checks to ensure that, among other things, we can provide you with the best possible rate.

A simplified application process

Before applying, use our loan repayment calculator to get a rough estimate of what you might have to repay. However, following a full application (and after performing a complete assessment of your application and personal circumstances), your repayments and rate may differ.

You can apply online quickly or contact us for assistance.Borrow from £1,000 to £35,000 over 1-7 years. If you already have an account with us, you can apply to top up your loan with a minimum additional amount of £1,000 above your original balance.

Who is eligible for a loan?

You can apply for a debt consolidation loan, mortgage or car loans, to name just a few, if you’re 22 and older. You must hold a UK personal current account, you need to have resided in the UK for a period of at least 3 years as well as be employed or have a regular income (like pension, for example).

Worried about missing a payment? Talk to us

If you think you might miss a payment, get in touch with us ASAP so that we can help you with a way forward and get you back on track. Our team is always ready to assist.

Something to think about

A consolidation loan is a great way to help you tackle your debt-if it’s the right option for you. No two people are the same, so what might work for one person might not work for the next. Which is why before taking out a new loan, you need to thoroughly evaluate your individual situation so that you can determine if going ahead will indeed be beneficial to you.

Consider the new loan’s term length, the monthly repayment costs as well as any early repayment penalties on any of your original debts. Calculate the full cost of your debt against the full cost of the new loan to help you decide.

Customer Reviews & Testimonials

Tesco Bank Contact Details

Physical Address

- 2 S Gyle Cres Edinburgh England EH12 9FQ United Kingdom

- Get Directions

Postal Address

- PO Box 27014, Glasgow, G2 9FE

Opening Hours

- Monday Open – 24 Hours

- Tuesday Open – 24 Hours

- Wednesday Open – 24 Hours

- Thursday Open – 24 Hours

- Friday Open – 24 Hours

- Saturday Open – 24 Hours

- Sunday Open – 24 Hours