Zopa

Updated

- Peer-to-peer loans up to £25,000

- Low-interest starting from 15.4%

- Repayment up to 5 years

In-page navigation

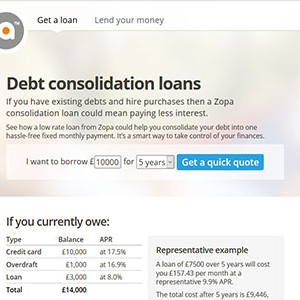

Author Zopa. Screenshot of Zopa website. [Accessed September 5, 2019]

About Zopa

Doing things differently is exactly what we are about.

The first of our kind, we revolutionised the way people access and manage their money. Previously, banks were the first choice for borrowing and lending, however, they had higher demands and lower rewards.

Simple loans, fast investments

We recognised this problem and so created the first peer-to-peer lending platform, which directly matches people looking for lower rate loans with investors looking for higher return investments. Because we do this conveniently online, this allows us to lower our costs, meaning our customers can maximise on benefits. You should be in control of your finances. Our philosophy is simple: loans should help you, not hinder you, and investing should be both ethical and rewarding.

Shaping the future of finance

Since 2005, we have been shaping the future of finance by making the process of borrowing and lending money simpler and fairer for the UK public. We’ve developed a trusted reputation over the years built on innovation, technology and delivering award-winning customer service. There’s no ‘one size fits all’ attitude with us. Whether it’s a quick loan or better rewards for your investments, we’ve got you covered.

Zopa Services

Our 10 plus years’ experience coupled with our team of highly-skilled, knowledgeable individuals.

The numerous awards we have won (most noticeably, the Trusted Loan Provider award which we’ve won 8 times- since 2010), prove that putting your faith in us is the safe option.

Loans we offer you

We offer personal loans to meet a variety of your needs. For example, you can get a loan to buy a new car, make some home improvements or even pay off your credit cards. Just let us know what you would like to do and we’ll gladly see if we can help. Our rates tend to be lower than that offered by banks and we don’t charge early repayment fees.

Simpler loan processes

Keeping things simple is what we strive to achieve throughout our entire processes, from the moment you first contact us until the very end. Our online application takes the frustration out of filling endless paperwork and makes applying quick and easy. You can also get a personalised loan rate on our platform. Just choose the amount you want to borrow (£1,000 to £25,000), select the term, fill in our short form, you’ll get your personal rate in 3 minutes! What’s more, this won’t affect your credit score.

Zopa Product Details

- Loan Type Peer-to-peer loans

- Interest Rate from 15.4%

- Loan Amount up to £25,000

- Repayment 1 year to 5 years

Summary of Services

- Apply for loan online

- No charges for overpayment

- Access money within 2 hours of approval

Here to keeo you satisfied

Choose between our Zopa Core and Zopa Plus products, each with different risks and returns, depending on your individual needs. You can start investing from £1,000.

Although we make everything simpler for you, in no way does this mean that we cut any corners? In fact, we simultaneously simplify everything while keeping a very high-quality standard. Giving you the best customer experience is something that we never compromise on.

Using technology to bring innovation

Technology has allowed us to connect like-minded people in a trusted and safe way. Through technology, we cut out the middlemen (banks) and connect lenders directly to trusted borrowers. By eliminating banks, we are able to maximise the benefits for both borrowers and lenders: borrowers can get the funds that they need faster with a lot less hassle and lenders can enjoy better returns on their investments.

So, in a nutshell, how does no red-tape, no nasty hidden fees and no high charges sound to you? If your answer is ‘good, we agree with you!

Manage your risk

We help investors manage risk in three ways: a thorough credit risk policy, a highly efficient recoveries policy and diversification of investments. We make managing your money very seriously and work hard to keep loan defaults low.

We’re transparent

Like our customers, we believe in always being transparent with you. We are completely upfront about all the fees we will charge you, so you will never be caught off guard. These will be communicated to you clearly when you take out a loan with us; you can also access this information easily on our website.

Move between products

Move money easily by reinvesting in a different product or buy and sell your loans to other willing investors, allowing you to access your money quicker, should you need it. There is a wide variety of loans to choose from including car loans and business loans.

Customer Reviews & Testimonials

Zopa Contact Details

Physical Address

- 47-49, Cottons Centre, Tooley St London England SE1 2QG United Kingdom

- Get Directions

Opening Hours

- Monday 08:00 – 20:00

- Tuesday 08:00 – 20:00

- Wednesday 08:00 – 20:00

- Thursday 08:00 – 20:00

- Friday 08:00 – 20:00

- Saturday 09:00 – 17:30

- Sunday 09:00 – 17:30